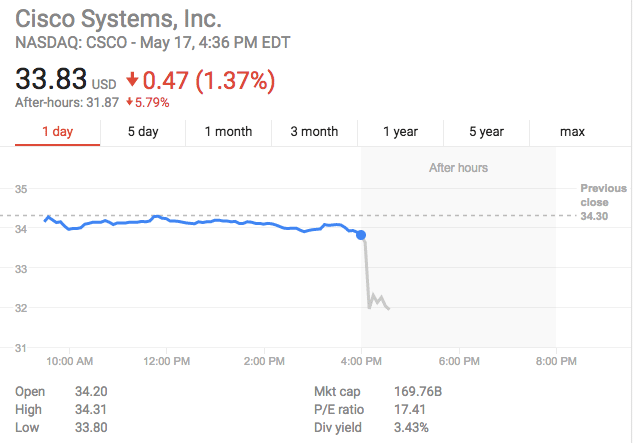

Cisco announced its third quarter earnings. The company saw a sharp sell off of its stock in after hour trading after releasing earnings. While the earnings as a whole weren’t bad, the company predicted a lower than analysts estimate for next quarter’s revenue. The company also announced an additional 1,100 layoffs.

Looking at the numbers, Cisco is reporting a revenue of $11.9 billion down slightly from last year’s $12 billion. On net income, the company is reporting a GAAP new income of $2.5 billion (up some from this time last year, $2.3 billion) and a non-GAAP of $3 billion (again up slightly from last year’s $2.9 billion). This works out to diluted earnings per share of $0.50 and $0.60. Gross margin for this quarter was 63% GAAP and 64.4% non-GAAP. Operating income was $3.2 billion GAAP and $3.9 billion non-GAAP. Cash and cash equivalents were down to $68 billion at the end of the quarter from last quarter’s $71.8 billion.

In this quarter Cisco has been on a spending spree acquiring companies at what seems to be left and right. The company acquired AppDynamics, Viptela, and MindMeld as well as the Advanced Analytics team and associated advanced analytics intellectual property developed by Saggezza. While that seems good, the stock took a beating as the company also announced a restructuring plan that includes the elimination 1,100 more workers. The company also made a more modest revenue predications for this quarter, under analysts expectations.

Sign up for the StorageReview newsletter