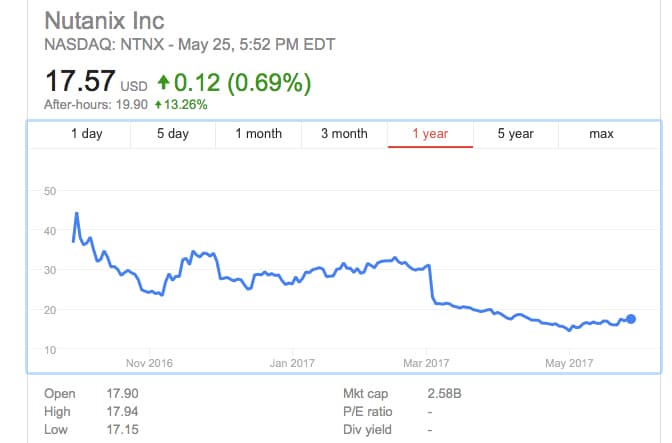

For the second time in a row, Nutanix has reported, “record revenue” in its quarterly financial report. This marks the third report since going public, again making it a bit easier to hit a record but is still impressive for the company to hit relative high revenue multiple times in a row. It is also worth noting that Nutanix was able to beat analysts’ expectations this quarter causing a spike in the after hours trading price.

For the second time in a row, Nutanix has reported, “record revenue” in its quarterly financial report. This marks the third report since going public, again making it a bit easier to hit a record but is still impressive for the company to hit relative high revenue multiple times in a row. It is also worth noting that Nutanix was able to beat analysts’ expectations this quarter causing a spike in the after hours trading price.

Nutanix is reporting revenue this quarter of $191.8 million up from $182.2 million last quarter and up 67% year-over-year from $114.7 million in the third quarter of fiscal 2016. The company saw a GAAP net loss of $112 million which is up some from last quarter’s $93.2 million (this comes out to a net loss of $0.78/share). Non-GAAP net loss was $46.8 million compared to the $39.9 million last quarter (loss per share comes out to $0.42). The company saw a GAAP gross margin of 56.6%.

Nutanix has kept its steady customer growth, adding an additional 790 customers bringing the total to 6,172 end-customers. The new customers include: Caterpillar Inc., KYOCERA Communication Systems Co., Ltd., MobileIron, SAIC Volkswagen, Société Générale, and Sprint. They have also added support for new hardware systems and announced new partnerships. Nutanix also reported $234.1 million in billings this quarter.

Next quarter the company is expecting revenue of $215 and $220 million, a gross margin of roughly 58%, and a net loss of $0.38/share.

Sign up for the StorageReview newsletter