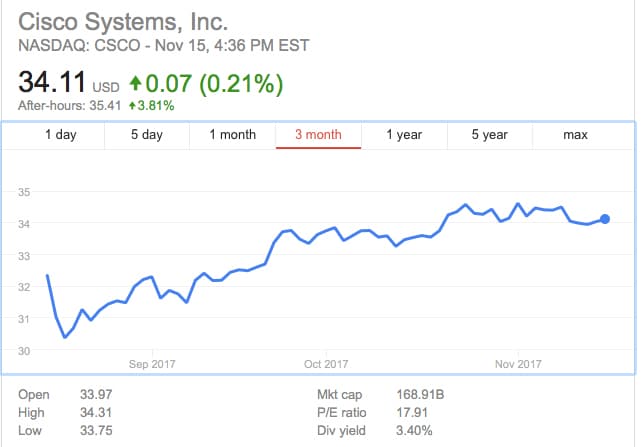

Today Cisco announced its first quarter earning for the fiscal year 2018 for the period ended October 28, 2017. The numbers are down a bit from this time last year but still looking fairly good in general. Cisco’s stock, which has been gradually climbing through this quarter, saw an uptick in after hour trading as soon as the earnings hit the wire.

Looking at the numbers for the quarter, Cisco is reporting revenue of $12.1 billion down 2% from the same time last year and even with last quarter’s revenue. The company is reporting a GAAP net income of $2.4 billion or $0.48/share (and even with last quarter) and non-GAAP net income $3 billion or $0.61/share (down slightly from last quarter’s $3.1 billion). Gross margin was 61.2% GAAP and 63.7% non-GAAP, down slightly on GAAP from 62.2% last quarter.

Cisco is also reporting a 7% drop in operating expenses, bringing the number down to $4.7 billion GAAP and $4 billion non-GAAP and down 3%. On the same note, Operating income was also down, $2.8 billion or down 4% GAAP and $3.7 billion or 5% non-GAAAP. Cash flow from operating activities was $3.1 billion up from $2.7 billion a year ago.

Looking forward to the next quarter, Cisco is predicting 1-3% growth in revenue Y/Y; GAAP EPS between $0.46 to $0.51; Non-GAAP gross margin between 62.5% – 63.5%; and a non-GAAP EPS between $0.58 – $0.60. Also, knowing Cisco, they will most likely buy a dozen or so more companies.

Amazon

Amazon