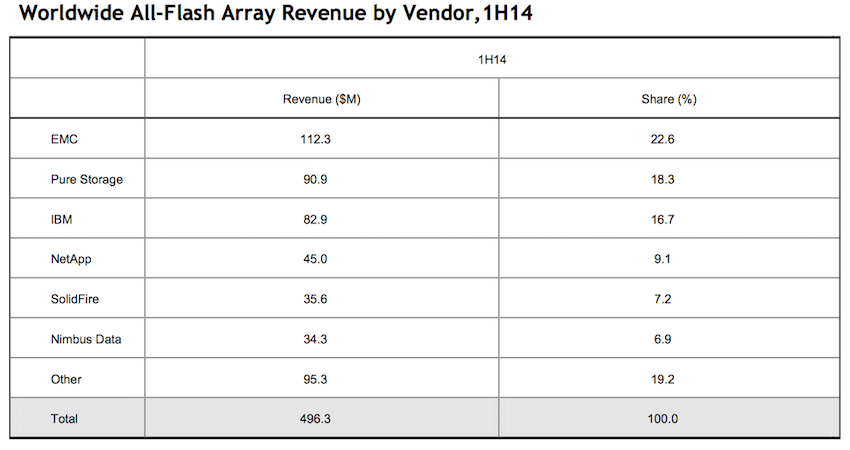

A recent study released by IDC shows EMC leading the market share for both all-flash (AFA) and hybrid arrays, based on revenue. The numbers are based off of revenue by vendor for the first half of 2014 and the total amount of TBs shipped.

A recent study released by IDC shows EMC leading the market share for both all-flash (AFA) and hybrid arrays, based on revenue. The numbers are based off of revenue by vendor for the first half of 2014 and the total amount of TBs shipped.

EMC is fairly new to the all-flash array game. EMC entered the game in the second half of 2013 with the XtremIO. With just a hitch, they were able to go to the leading position in the market, based on revenue, in less than a year. Pure Storage took the number two spot with roughly $91 million and was followed closely by IBM for third. After that point the drop off is substantial with NetApp, Solidfire and Nimbus rounding out the top 6.

EMC came in the number two spot, behind IBM, for the raw capacity shipped for all-flash array, shipping over 13,404TB of raw capacity compared to IBM's 22,773TB. Pure Storage, Solidfire and Nimbus all tossed in about 7,500TB each and Violin took sixth with 5,583TB.

EMC also rose to the top of the hybrid flash array market in both revenue by vendor and in raw capacity shipments. EMC’s revenue was one and half times that of NetApp’s, which came in second. From there the revenues drop quickly with HDS, IBM, Dell and HP finishing the list. Turning to capacity, based on raw SSD capacity shipped in a hybrid configuration, EMC shipped 45,273TB barely edging out Dell by 600TB. HDS came in third with 37,490TB with NetApp, IBM and HP rounding out the list. Interestingly the "other" group shipped 24,474TB, indicating a terrific appetite for hybrid arrays from those other than the Big 6.