Discuss

Today Pure Storage announced that is has filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission relating to a proposed initial public offering of its Class A common stock. Pure Storage is planning on going public however they have not yet stated the amount of shares or the price range of their IPO. They have stated that their ticker symbol would be PSTG.

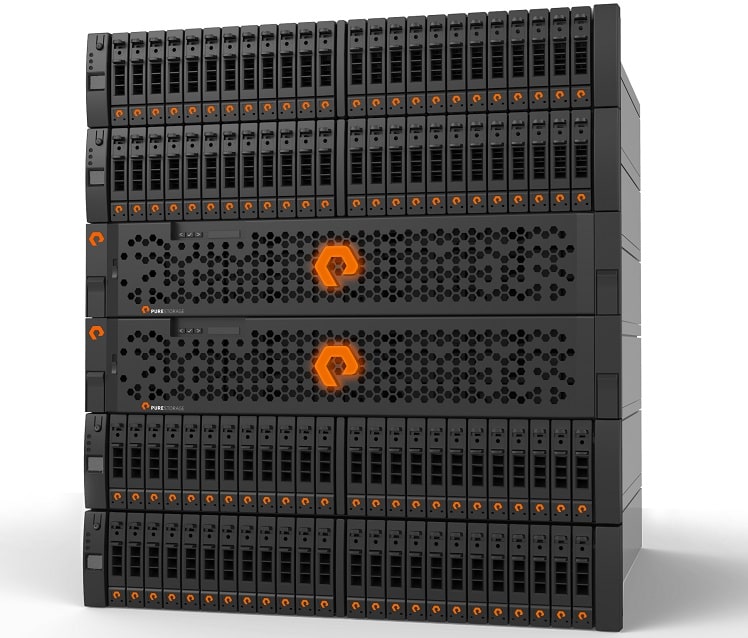

Founded in 2009 and based out of Mountain View, California, Pure Storage primarily focuses on flash arrays, which they simply name FlashArray followed by a number or letter signifying difference in models. The latest FlashArray was the FlashArray//m with over 400TB of usable storage and 300,000 IOPS in performance. Aside from raising hundreds of millions of dollars in funding, they have also won several awards and notable mentions such as a silver winner in the Wall Street Journal 2012 Technology Innovation Awards. Pure Storage has been awarded hundreds of patents and is part of the OpenStack Foundation. Pure Storage also offers a unique upgrade plan titled, Evergreen. Through Evergreen customers can deploy their storage once and upgrade it over and over again in-place for generations. Pure Storage achieves this upgrade model though a combination of its modular FlashArray software-defined architecture with Forever Flash, the company’s standard maintenance program.

Morgan Stanley and Goldman, Sachs & Co. will act as lead book-running managers for the proposed offering. Barclays, Allen & Company LLC and BofA Merrill Lynch will act as book-running managers, and Pacific Crest Securities, a division of KeyBanc Capital Markets, Stifel, Raymond James and Evercore ISI will act as co-managers. The offering will be made only by means of a prospectus.

Sign up for the StorageReview newsletter