Yesterday, Pure Storage announced the pricing of its Initial Public Offering (IPO) at $17 a share for 25 million shares. We first mentioned Pure filing for its IPO in August. This was immediately met with criticism surrounding how Pure was reporting (or failing to acknowledge errors in) its sales data, prompting Gartner to apologize over their reporting. Today Pure Storage is currently being traded on the NASDAQ with the ticker of PSTG.

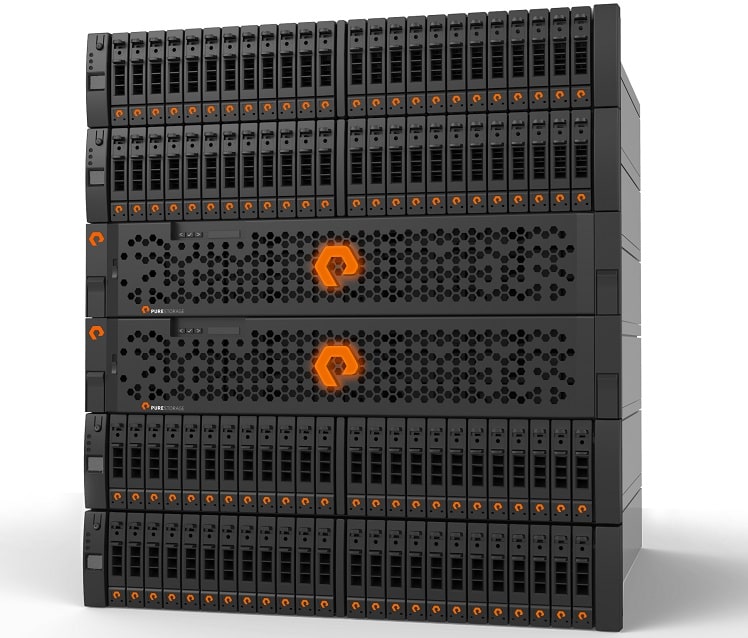

Founded in 2009 and based out of Mountain View, California, Pure Storage primarily focuses on flash arrays, which they simply name FlashArray followed by a number or letter signifying difference in models. The latest FlashArray was the FlashArray//m with over 400TB of usable storage and 300,000 IOPS in performance. Aside from raising hundreds of millions of dollars in funding, they have also won several awards and notable mentions such as a silver winner in the Wall Street Journal 2012 Technology Innovation Awards. Pure Storage has been awarded hundreds of patents and is part of the OpenStack Foundation. Pure Storage also offers a unique upgrade plan titled, Evergreen. Through Evergreen customers can deploy their storage once and upgrade it over and over again in-place for generations. Pure Storage achieves this upgrade model though a combination of its modular FlashArray software-defined architecture with Forever Flash, the company’s standard maintenance program.

As mentioned, in August Gartner reported a significant difference in revenue, $276,329,000, from what Pure reported in product sales, $154,836,000, for 2014. Though Gartner was quick to issues an apology and an explanation to their reporting, the most telling aspect was that all vendors receive the estimates and review them for accuracy. Pure Storage had the estimate and didn’t correct Gartner. Gartner’s mistake made Pure Storage look good, especially right before its IPO, however this could be one of the possible reasons that trading is of to a bumpy start. Issues such as the above shouldn’t happen in the future as now Pure must disclose their numbers now that they are publicly traded. As a point of comparison with the above mix up with Gartner, the corrected numbers show the entirety of Pure Storage at 11.5% of the market share for 2014, while one EMC product line, XtremeIO, makes up nearly three times that with 34.1% of market share.

Pure Storage’s stock opened under its IPO of $17 and has dropped about 6% by midday trading. Whether this is reflective of its sales data reporting issues or the overall downward trend of the market for its opening day has yet to be seen. Pure Storage expects to raise $425 million for its IPO.

Discuss this story

Sign up for the StorageReview newsletter