Among the findings in this year’s Cloud Price Index, 451 Research disclosed that lowering the cost of cloud services hasn’t helped those looking to gain market share. In fact, the opposite is true: higher value services are the key to profitable growth.

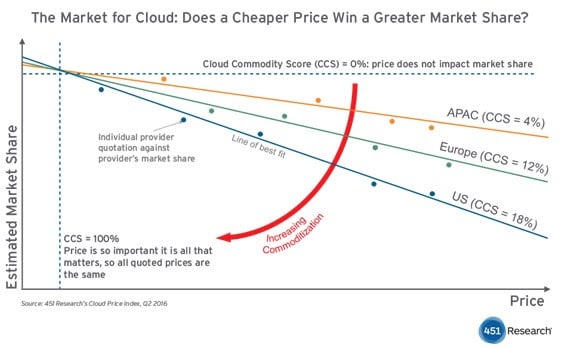

To illustrate this, 451 Research developed what’s called a Cloud Commodity Score (CCS). Tracking consumers’ sensitivity to price by region: a higher CCS means a higher impact of cost upon market share. Among the European, APAC, and US markets, the US is most likely to see cloud providers increase in market share with a lower price—but the CCS is still quite low there at 18%. It is the cheapest market for cloud services.

Though the cost of virtual machines have dropped 12% in the last 18 months, the cost of storage has remained more or less stable. Combined with the fact that data markets will dramatically increase in size by 2019, the report indicates that profitability is more likely to follow better value options that provide more features, local hosting, and improved support. The report concludes that as the prices of bulk services approach zero, cloud service providers are likely to add the aforementioned features to offer a more “premium” experience, and join in a higher price bracket to stay financially competitive.

Both the European and Asia-Pacific markets are more expensive than the US for cloud services, by 3 and 19% respectively. This is primarily due to how fractured the markets are in each region. Consequently, the report highlights that prospects are better for service providers in Europe and Asia than they are in the US market—especially with their greater need for cross-border data protection.

Discuss this story

Sign up for the StorageReview newsletter