Today Cisco announced its fourth quarter earnings as well as its fiscal year earnings. Unlike much of the other earnings reporting we do here, Cisco is looking pretty good in terms of numbers from the previous year’s earning reports. Though their numbers aren’t bad they are announcing a restructuring plan that will costs roughly 5,500 jobs or 7% of its workforce. While this isn’t good news, it is better than the 14,000 that were reported earlier today.

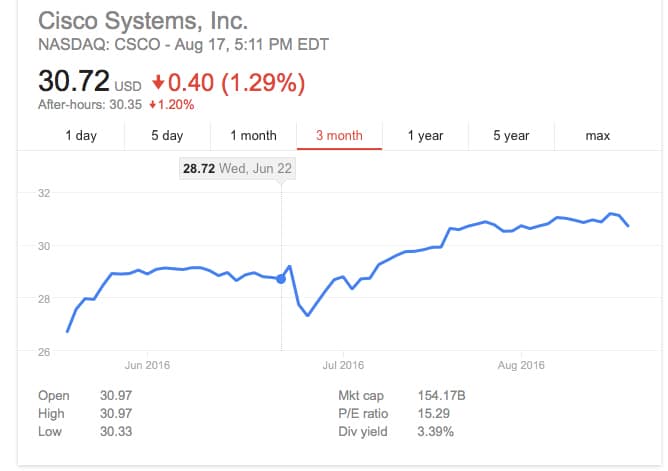

Image courtesy of Google Finance

As far as earnings for the fourth quarter go, Cisco is reporting a GAAP revenue of $12.6 billion (down from $12.8 billion a year ago), a net income of $2.8 billion (up from $2.3 billion a year ago), an earning per share (EPS) of $0.56 (also up from $0.45 from a year ago), and a gross margin of 63.1%. For the fiscal year, Cisco is reporting a revenue of $49.2 billion (the same as last year), a net income of $10.7 billion (up from $9 billion), EPS of $2.11 (up form $1.75), and a gross margin of 62.2%.

While these numbers certainly could be worse (take a pick at most of the other earnings reports we’ve ran in the last few months), Cisco is announcing a restructuring plan that will lead to the elimination of 5,500 positions. Cisco states that this plan is designed to optimize its cost base in lower growth areas while further investing in key growth areas: security, IoT, collaboration, next generation data center, and cloud. The costs saved from this action will be aggressively invested in areas of future growth. Cisco states that this restructuring will take place beginning in the first quarter of fiscal 2017.

Looking ahead, Cisco states that it is expected revenue for its next quarter to be between -1-1% growth, a Non-GAAP gross margin rate of 63-64%, and a Non-GAAP EPS of $0.58-$0.60. As of this writing Cisco’s stock didn’t seem to make any drastic changes and has been on an upward trend over the last year.

Sign up for the StorageReview newsletter