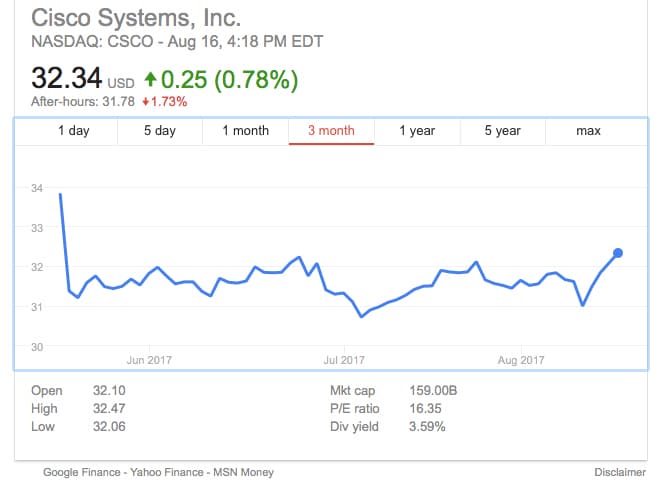

Today Cisco announced its fourth quarter and fiscal year earnings for 2017. The stock saw a sharp drop in after hours trading and is still running under where it was last quarter. While the overall numbers were better than expected, the company reported that sales were down year-over-year, which most likely started the selloff.

Looking at the numbers for the quarter, Cisco is reporting a revenue of $12.1 billion, up from last quarter’s $11.9 billion. The company is reporting a GAAP net income of $2.4 billion (or EPS of $0.48) and a non-GAAP net income of $3.1 billion (or EPS of $0.61). Gross margin was 62.2% GAAP and 63.7% non-GAAP, both continuing to fall over the last quarter’s. Cash flow was $4 billion up from $3.8 billion in the last quarter.

For the year, Cisco is reporting $48 billion in revenue down 2% from the year before. The company is reporting a net income of $9.6 billion GAAP and $12.1 Billion non-GAAP. The company also states that they have generated approximately $13.9 billion in cash flow and operating activities.

Looking to the future, Cisco is expecting a 1-3% decline in YoY revenue for the first fiscal quarter of 2018. The company is also expecting a non-GAAP gross margin between 63-64% and a non-GAAP EPS of $0.59 – $0.61.

Sign up for the StorageReview newsletter