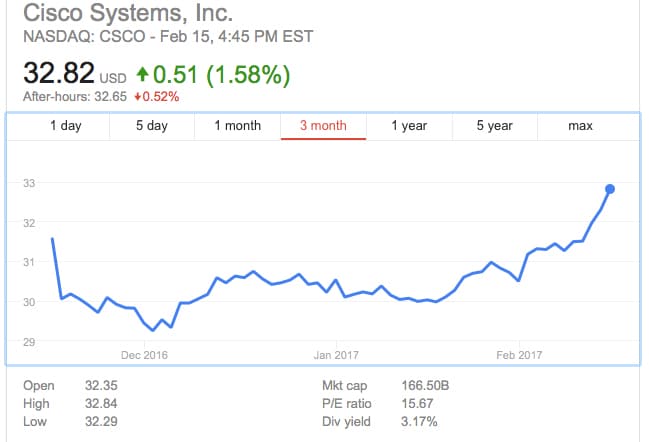

Today Cisco announced its second quarter earnings. As the trend of poor earning reports seems to be turning around, Cisco’s earnings aren’t fantastic but they are a far cry from some of the numbers we’ve seen in the last six months. Cisco also announced an increase in quarterly cash dividends. Cisco’s stock performance is up slightly from last quarter.

As far as the numbers go, Cisco is reporting revenue of $11.6 billion down slightly from this time last year ($11.9 billion). Cisco also reporting a GAAP net income of $2.3 billion ($0.47/share in diluted earnings per share) down from $3.1 billion a year ago. Non-GAAP net income was $2.9 billion ($0.57/share diluted EPS) the same as last year. GAAP product gross margin was 61.1% down from 61.3% last year. Non-GAAP product gross margin was 62.4% down from 63.3% last year. Operating expenses were $4.4 billion GAAP and $3.8 billion non-GAAP. With operating income being $2.9 billion GAAP and $3.6 billion non-GAAP. Cash and cash equivalents were $71.8 billion at the end of the quarter.

Looking forward, Cisco is being conservative in their estimates with year on year estimates of 0 to -2% revenue, non-GAAP gross margin of 63% – 64%, non-GAAP operating margin rate of 29% – 30%, non-GAAP tax provision rate of 22%, and non-GAAP EPS of $0.57 – $0.59. Part of the reason for these lower estimates is that the same quarter last year had an extra week, and more time to draw revenue.

The Cash dividends this quarter were $0.26/share up from $0.21/share this same time last year.

Amazon

Amazon