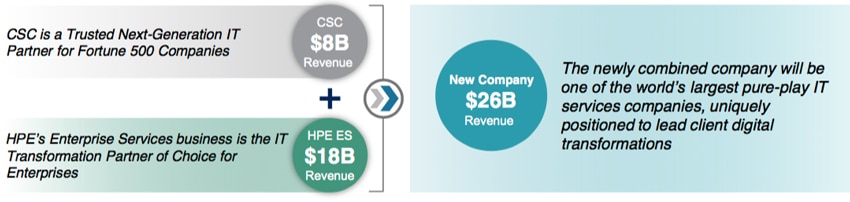

This week CSC announced that its board of directors unanimously approved a plan to merge the company with the Enterprise Services segment of Hewlett Packard Enterprise (HPE). The combined company would make one of the world’s largest pure-play IT services companies. To put the size in some sort of perspective it would be expected to have annual revenues of $26 billion and more than 5,000 clients in 70 countries. The merger is expected to be completed by the end of March 2017, subject to shareholder and regulatory reviews and approvals.

Six months ago CSC broke into two separate publicly trading companies: CSC, to serve commercial and government clients globally, and CSRA, which serves public sector clients in the United States. CSC positioned itself as a next-generation IT services company built specifically to respond to a changing market – one that is driving clients to move rapidly toward digital transformation. In the last six months, CSC has taken several steps to make how it positioned itself a reality.

The combined company will have substantial scale to serve clients more efficiently and effectively worldwide. The new company states that it will be able to rapidly accelerate their already-improved financial and operational performance. CSC’s CEO, Mike Lawrie, will become chairman, president and CEO of the new company. CSC’s CFO, Paul Saleh, will keep his role after the companies combine. On the HPE side, the president and CEO, Meg Whitman, will join the new company’s Board of Directors. And the EVP and GM of HPE Enterprise Services, Mike Nefkens, will report to Lawrie.

Benefits for customers would include:

- World-class strength in customer service and IT operations – among the safest pair of hands in the industry, deploying a broader set of resources and expertise to benefit clients

- Market-leading industry and technology expertise – industry leading experience and IP in areas such as financial services, healthcare and life sciences, transportation, consumer products, and insurance, helping customers transform faster;

- Global scale – operating 85 delivery centers and 95 data centers across 70 countries, providing access to the most efficient IT services in the world

- Technology independence and best-in-class capabilities in next-generation cloud, security, application development and modernization, big data and analytics, mobility, workplace, and sophisticated business process and IT services

- Combined leadership bringing deep turnaround experience and transformation capabilities, customer relationships, sales/GTM, industry and functional expertise

- Expanded best-of-breed technology partnerships that provide greater choice of solutions

- Enhanced innovation, R&D, and investment opportunities for new services and solutions.

As far as the transaction itself, it should deliver approximately $8.5 billion to HPE’s shareholders on an after-tax basis. This includes an equity stake in the newly combined company valued at more than $4.5 billion, a cash dividend of $1.5 billion, and the assumption of $2.5 billion of debt and other liabilities related to the HPE Enterprise Services segment. The merger of the two businesses is expected to produce first-year synergies of approximately $1 billion post-close, with a run rate of $1.5 billion by the end of year one.

Sign up for the StorageReview newsletter