Today, in a surprise to almost no one, Dell Technologies Inc. made its return to the publicly traded markets, specifically the NYSE, it was previously traded on the NASDAQ. Dell went private almost six years ago and in that time bought EMC. The company will be traded under the symbol DELL.

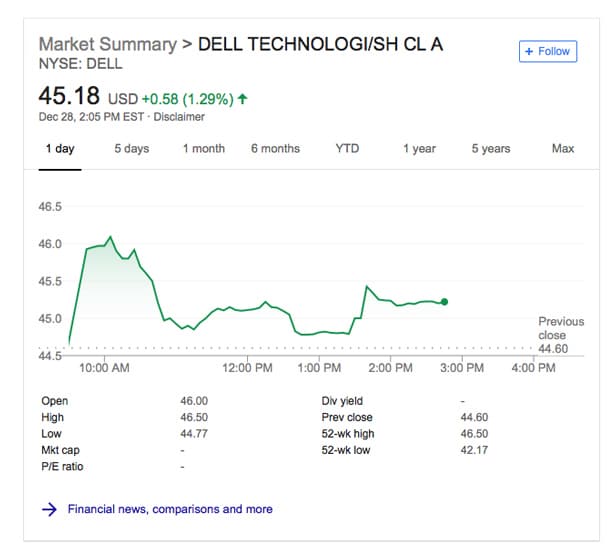

Forgoing the normal IPO process, the company instead bought back shares of DVMT.N, which tracked the financial performance of VMware (of which, Dell holds an 81% stake). This deal is reported as being worth around $21.7 billion. This also means that Dell could avoid talking about its debt that is reported at $52.7 billion. The shares opened at $46 for a market valuation of $16 billion.

Dell was previously a publically traded company for 25 years before going private in 2013. At the time it was primarily known as a PC maker that didn’t embrace the tablet revolution and was suffering for it. While private the company branched out in many areas and slowly built it reputation on its servers and HCI devices. As stated, the company bought EMC for $67 billion, the largest acquisition at the time. This solved the company’s storage problem and brought them to new levels of innovation. Now Dell is gaining market share in Servers, Storage, and HCI (at the top of IDC’s trackers) and winning multiple awards, including several from StorageReview. Overall the company is in a much better position than it was when it left the market in 2013.

Dell Technologies Investor Relations

Sign up for the StorageReview newsletter