![]() IDC’s Spring 2011 Storage User Demand Study (SUDS) has been released and includes interesting insights on enterprise storage market trends and their preferred storage brands by usage scenario. The main takeaways – EMC dominates mindshare, midrange storage is the most favored and many are already using outsourced storage solutions.

IDC’s Spring 2011 Storage User Demand Study (SUDS) has been released and includes interesting insights on enterprise storage market trends and their preferred storage brands by usage scenario. The main takeaways – EMC dominates mindshare, midrange storage is the most favored and many are already using outsourced storage solutions.

IDC’s Spring 2011 Storage User Demand Study (SUDS) has been released and includes interesting insights on enterprise storage market trends and their preferred storage brands by usage scenario. The main takeaways – EMC dominates mindshare, midrange storage is the most favored and many are already using outsourced storage solutions.

For the current SUDS Survey, there were 998 respondents across 15 countries. Respondents varied in company size, from 50 employees to over 10,000. One-quarter had less than 25TB under management, 24% had between 26TB and 100TB, one-third had between 101TB and 1,000TB, and 21% of

the had over 1,001TB.

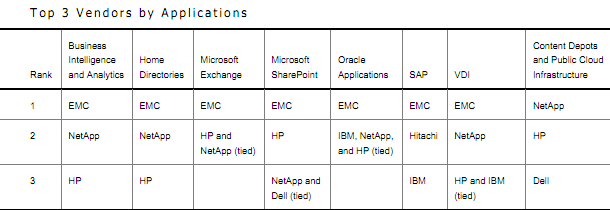

IDC measured brand preference based on specific application usage. EMC clearly dominates the list, which makes sense, they’re the largest player in the space. NetApp comes in second, taking the top spot for “Content Depots and Public Cloud Infrastructure” and several second place nods. HP, Dell, IBM and Hitachi round out the top three in each category.

For the next 12 months midrange storage systems ($25,000-$250,000) are expected to grow the fastest with entry-level (sub $25,000) following closely behind. Other key findings include:

- Many users already leverage third-party storage capacity (outsourced storage)

- There is a large interest in Fibre Channel over Ethernet, but there is very minimal commitment

- Midrange or modular storage systems are the most favored storage systems among all users for all types of data and use cases

- Over the next 12 months, end users are not likely to change the way they deploy, attach, and use storage systems dramatically

The IDC Spring 2011 SUDS report is available here.