EMC has released its fourth quarter and full year earnings for 2015. Unlike several of the news pieces we’ve covered recently (such as Violin Memory, Nimble, and to a certain degree IBM) EMC’s earnings are looking pretty good. As the deal with Dell acquiring EMC for $67 billion is still going through according to Joe Tucci, EMC Chairman and CEO, EMC will become a privately held company and will no longer have to report its earnings.

EMC has released its fourth quarter and full year earnings for 2015. Unlike several of the news pieces we’ve covered recently (such as Violin Memory, Nimble, and to a certain degree IBM) EMC’s earnings are looking pretty good. As the deal with Dell acquiring EMC for $67 billion is still going through according to Joe Tucci, EMC Chairman and CEO, EMC will become a privately held company and will no longer have to report its earnings.

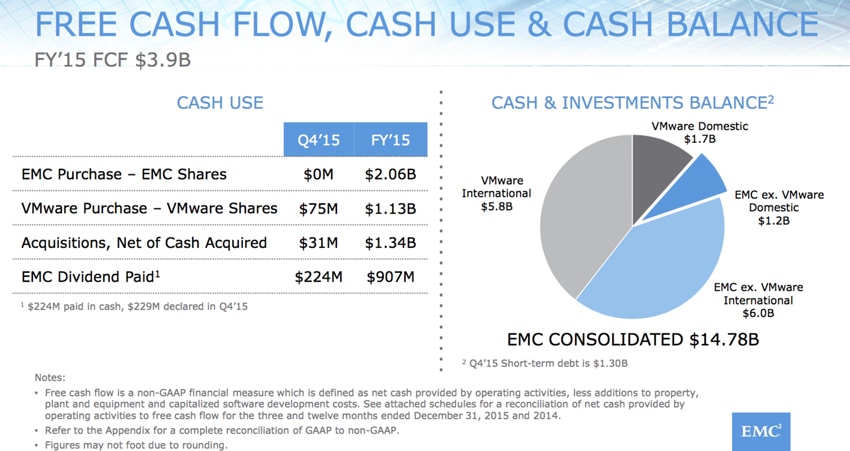

Looking at the fourth quarter earnings revenue was $7 billion, which is flat year over year. GAAP net income was $771 million (non-GAAP income was $1.3 billion in 4Q) and GAAP earnings per weighted average diluted share was $0.39 in the fourth quarter (non-GAAP earnings per weighted average diluted share was $0.65 in 4Q). EMC also generated $1.9 billion in operating cash flow and $1.5 billion in free cash flow in 4Q. At the end of the quarter EMC had $14.8 billion in cash and investments and returned roughly $229 million to shareholders through dividends.

Looking at the full year, GAAP revenue was up 1% year over year at $24.7 billion (non-GAAP revenue was $24.8 billion). Net income was $2 billion GAAP and $3.6 billion non-GAAP. This makes their earnings per weighted average diluted share was $1.01 GAAP, and $1.82 non-GAAP.

A few other highlights from the report include VMware’s 4Q and full-year revenue were up 10% and 9% year over year, respectively. Pivotal’s 4Q revenue is up 25% year over year and its annual recurring revenue is up 40% compared to the previous quarter. EMC XtremIO ended the year with over $1 billion in revenue. And VCE exited 2015 with an annualized demand run rate exceeding $3 billion.

While it was mostly good news there were a few misses (EMC can’t win them all). EMC Information Infrastructure’s 4Q revenue was down 4% year over year with its full-year revenue being down 2%. Information Storage was also down 4% in 4Q year over year with its full year being down 1%. Consolidated 4Q revenue from North America, Asia Pacific, and Japan was flat, Europe, Middle East and Africa region was down 1%, and Latin America revenue was down 16% year over year.

Sign up for the StorageReview newsletter