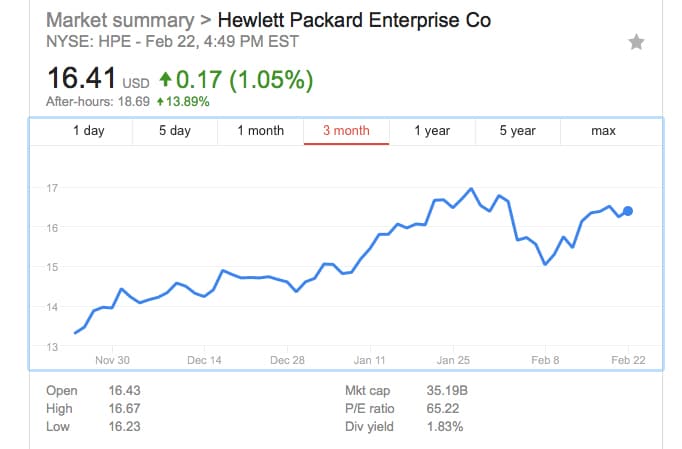

Hewlett Packard Enterprise (HPE) reported its earnings for its first fiscal quarter of 2018, that ended January 31, 2018. The company is reporting good numbers overall along with higher diluted earnings per share that it is partially attributing to the recent tax reform law. Stock performance has been trending upward this quarter with a large spike in after hour trading.

Hewlett Packard Enterprise (HPE) reported its earnings for its first fiscal quarter of 2018, that ended January 31, 2018. The company is reporting good numbers overall along with higher diluted earnings per share that it is partially attributing to the recent tax reform law. Stock performance has been trending upward this quarter with a large spike in after hour trading.

Looking at the numbers, the company is reporting net revenue of $7.7 billion, a jump of 11% from the same time last year and the same as last quarter. HPE is reporting a GAAP diluted earnings per share (EPS) of $0.89 a big jump from the expected $0.01-$0.05 (according the HPE they believe this is primarily due to the recent tax reform law passed in the United States). Non-GAAP diluted EPS was reported at $0.34, again up from expectations of $0.20-$0.24.

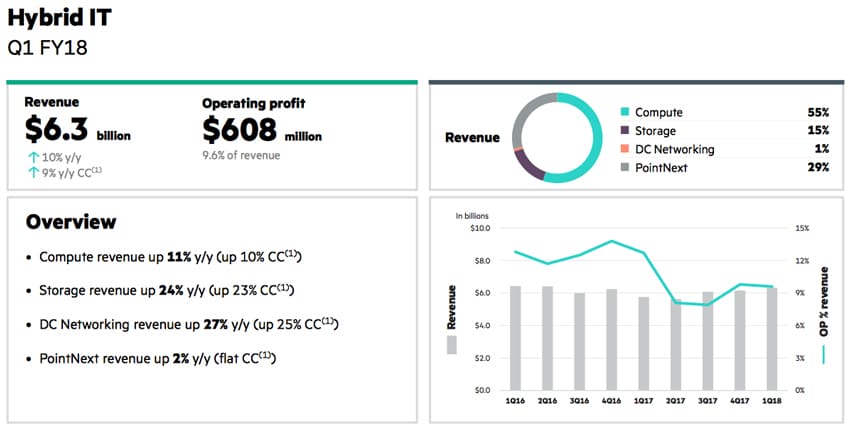

The company on a whole saw positive results with HPE’s hybrid IT going up 10% YOY, compute revenue was up 11% YOY, storage revenue was up 24% YOY, and Pointnext revenue was up slightly, 2%. Intelligent Edge also saw an overall revenue increase of 9% with HPE Aruba Product revenue up 9%, and HPE Aruba Service revenue up 6%. HPE’s financial Services also saw a nice uptick with $888 million in revenue or 8% year over year.

HPE returned $862 million to shareholders through repurchases and dividends and intends to return another $7 billion through FY19, through more share repurchases and a 50% dividend increase staring in the third quarter of this fiscal year. Next quarter, the company is expected GAAP diluted EPS of $0.10-$0.14 and non-GAAP diluted net EPD to be between $0.29-$0.33.

Sign up for the StorageReview newsletter