![]() IMB has released its fourth quarter earnings and it is a bit of a mixed bag. While earnings beat expectations (earning $4.84 per share on $22.06 billion in revenue versus the expectations of $4.81 a share on $22.02 billion in revenue), the company’s overall earnings per share are down roughly 17% from this same quarter last year. The report also highlighted the fact that IBM was shifting its focus from software to cloud, Internet of Things, and analytics. IBM’s stock has taken a hit on the day following the report; this could be related to the fact that the company is forecasting earnings of $13.50 versus the analysts’ $15.00 or the total market taking a hit.

IMB has released its fourth quarter earnings and it is a bit of a mixed bag. While earnings beat expectations (earning $4.84 per share on $22.06 billion in revenue versus the expectations of $4.81 a share on $22.02 billion in revenue), the company’s overall earnings per share are down roughly 17% from this same quarter last year. The report also highlighted the fact that IBM was shifting its focus from software to cloud, Internet of Things, and analytics. IBM’s stock has taken a hit on the day following the report; this could be related to the fact that the company is forecasting earnings of $13.50 versus the analysts’ $15.00 or the total market taking a hit.

IMB has released its fourth quarter earnings and it is a bit of a mixed bag. While earnings beat expectations (earning $4.84 per share on $22.06 billion in revenue versus the expectations of $4.81 a share on $22.02 billion in revenue), the company’s overall earnings per share are down roughly 17% from this same quarter last year. The report also highlighted the fact that IBM was shifting its focus from software to cloud, Internet of Things, and analytics. IBM’s stock has taken a hit on the day following the report; this could be related to the fact that the company is forecasting earnings of $13.50 versus the analysts’ $15.00 or the total market taking a hit.

IBM is suffering from the same issue that is affecting several companies that have international investments, currency changes. However the impact of currency is now expected though it still takes its toll. In fact IBM’s CFO, Martin Schroeter, told CNBC that currency represented about a $7 billion impact on the company's revenue.

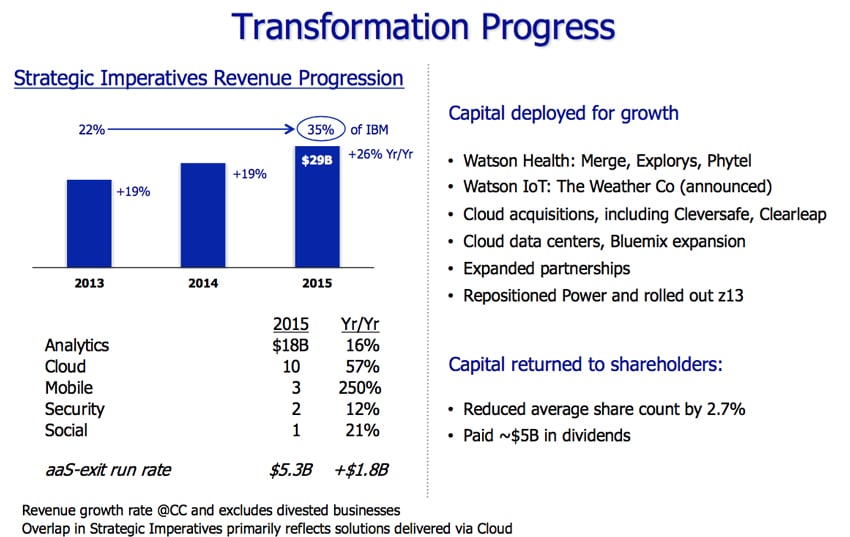

IBM saw some of its core business, software and hardware, take a revenue hit this quarter. Software revenue fell 11% to $6.8 billion compared to fourth quarter last year. Hardware only dropped 1% to $2.4 billion. However IBM saw some good news in what it refers to as its “Strategic Imperatives.” Strategic Imperatives are IBM’s cloud, analytics, and engagement platforms. Here IBM was a quarterly increase of 10% year to year and an increase of 17% to $28.9 billion for the entire year. Strategic Imperatives now make up 35% of IBM’s consolidated revenue.

IBM saw more good news related to its cloud business with total cloud revenue up 43% to $10.2 billion, this includes public, private and hybrid clouds. IBM saw a revenue increase of 50% in its cloud delivered as a service, which is part of its overall cloud business. IBM also saw revenue increase in its analytics, up 7%, and its mobile division, up 5%.

While their stock is down 18% from this time last year, the company is focusing more on aspects such as the cloud that are gaining more mainstream attention and could eventually lead to much higher profits down the road.

Sign up for the StorageReview newsletter