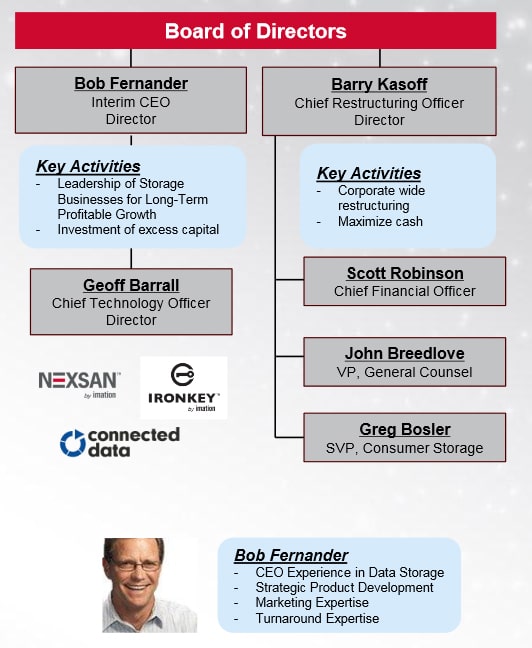

Imation has made a few major announcements concerning the structure of their company, including the immediate appointment of Bob Fernander as Interim CEO. Imation also announced the equity acquisition of Connected Data, which has been valued at roughly $7.5 million during the closing. Imation has stated that it intends to complete the transaction through a short-form merger as soon as practicable. Connected Data’s founder and CEO, Geoff Barrall, will take the role of Chief Technology Officer on Imation’s executive leadership team. In addition, Interim President Barry Kasoff was given the role of Chief Restructuring Officer and will work alongside Bob Fernander as they both will lead Imation’s restructuring plan.

While the transaction is subject to certain adjustments, roughly $4.4 million of consideration will be paid in Imation common stock, while roughly $500K will be paid in cash. $2.6 million in debt will be paid off by Imation. In addition, upwards of $5 million in both cash and shares in earn outs are possible, which is subject to Connected Data’s performance throughout all of 2016 and into the first half of the following year. Connected Data is expected to have over $7 million in standalone revenue in 2016 and the transaction will be immediately accretive to Imation.

Both Imation’s Board and executive team plan to continue their collaboration with its advisors to push change within the company as well as leverage strategic alternatives to maximize shareholder value, such as divestitures of its non-core and non-operating assets. On September 30, 2015, Imation indicated that their total cash balance is expected to be a minimum of $85 million while the corporate-wide restructuring plan is expected to be concluded by January 1, 2016.

Imation has a wide variety of products, which makes adding another somewhat interesting given their broad base. Imation currently sells everything from USB 3 drives to storage arrays via their Nexsan acquisition. Most of the portfolio is relatively niche however, surely a core thrust of the reorg plan will be to consolidate the offerings some and come up with a more cohesive brand strategy that resonates with their target markets.