Micron released their first quarter results for 2016 and missed revenue expectations. Analysts were looking for $3.46 billion in revenue and Micron reported $3.35 billion (Micron’s revenue was $4.57 billion this quarter last year). Not only that, Micron’s revenue prediction for this quarter, which is between $2.9 billion and $3.2 billion, is under what analysts are anticipating, $3.5 billion. The stock immediately took a hit dropping down to near its overall low for the year.

It wasn’t all bad news for Micron. Micron’s overall net income is $206 million or 19 cents per share. Once it is adjusted for items Micron’s earnings come up to 24 cents per share which beat analysts 23 cents per share estimate. While its stock dropped last night and into this morning it has recovered some floating around $14 midday. However its stock is down quite a bit from the beginning of the year. Their stock price started the year off around $35 and is now floating around $14 or about a 60% drop.

Micron points to the shrinking market of home PCs as a drag on its revenue. The fierce competition in the client SSD market is also taking a toll. Another aspect that is negatively impacting them is the seasonal weakness of the networking market and China’s delay in LTE build-out. While Micron may be losing ground in these areas they are picking up in other areas. They are seeing strong demand for their DDR4 in the enterprise segment and they expect their low power DDR4 volume to surpass their low power DDR3 by the third quarter. Micron has partnered with Intel to deliver what the two are calling a new category of memory with 3D XPoint. And Micron is seeing steady growth in some emerging markets such as automotive, Infotainment, and connected home.

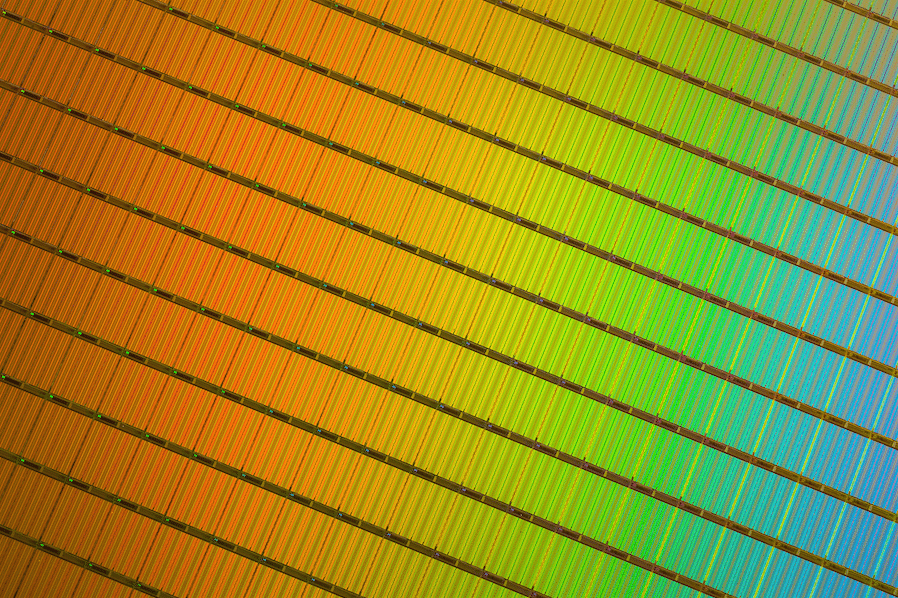

Micron states that its focus going forward this year will be ramping up its 20nm DRAM, working on gen two 3D NAND in manufacturing, and accelerating the development of advanced SSD controllers. Micron claims that its 3D NAND-based solutions will be available in the second half of fiscal 2016.

Sign up for the StorageReview newsletter