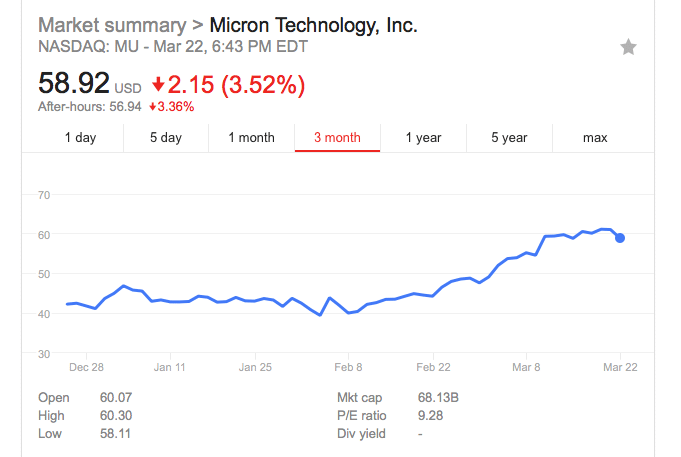

Today Micron Technology Inc. announced its second quarter earnings for its fiscal year that ended on March 1, 2018. Overall the company had a very good quarter reporting good numbers across the board. Their stock got dinged a bit getting wrapped up in the overall sink that hit the market this afternoon, however, it has trended upward throughout the quarter.

Today Micron Technology Inc. announced its second quarter earnings for its fiscal year that ended on March 1, 2018. Overall the company had a very good quarter reporting good numbers across the board. Their stock got dinged a bit getting wrapped up in the overall sink that hit the market this afternoon, however, it has trended upward throughout the quarter.

Today Micron Technology Inc. announced its second quarter earnings for its fiscal year that ended on March 1, 2018. Overall the company had a very good quarter reporting good numbers across the board. Their stock got dinged a bit getting wrapped up in the overall sink that hit the market this afternoon, however, it has trended upward throughout the quarter.

Looking at the numbers for the quarter, Micron is reporting revenue of $7.35 billion, up a whopping 58% from the same time last year ($4.64 billion) and up from last quarter’s $6.8 billion. Net income is reported as $3.39 billion GAAP or $2.67 diluted earnings per share (EPS) and $3.5 billion non-GAAP or $2.82 diluted EPS. A fair improvement over last quarter’s $2.68 billion GAAP and $2.99 billion non-GAAP. Operating cash flow for this quarter was a staggering $4.35 billion. Gross margin is reported as 58.1% GAAP and 58.4% non-GAAP.

The ever-increasing demand for faster performance and the trend toward flash is a great trend if you happen to be Micron. Micron is reporting very good numbers in all of its main units: Compute & Networking, Mobile, Embedded, and Storage. DRAM is still the main moneymaker for the company making up 71% of this quarter’s revenue.

Looking to the future, the company is expecting revenue in the range of $7.2-$7.6 billion next quarter. Gross margin is expected to fall between 57%-60%. And Micron is expecting diluted EPS of roughly $2.83.

Discuss this story

Sign up for the StorageReview newsletter