NetApp reported earnings for its first fiscal quarter of 2019 that ended July 27, 2018. The company delivered fairly good numbers. It stock seemed to bit all over the map after the earnings report but generally down as of this writing, but up from the beginning of the quarter.

NetApp reported earnings for its first fiscal quarter of 2019 that ended July 27, 2018. The company delivered fairly good numbers. It stock seemed to bit all over the map after the earnings report but generally down as of this writing, but up from the beginning of the quarter.

NetApp reported earnings for its first fiscal quarter of 2019 that ended July 27, 2018. The company delivered fairly good numbers. It stock seemed to bit all over the map after the earnings report but generally down as of this writing, but up from the beginning of the quarter.

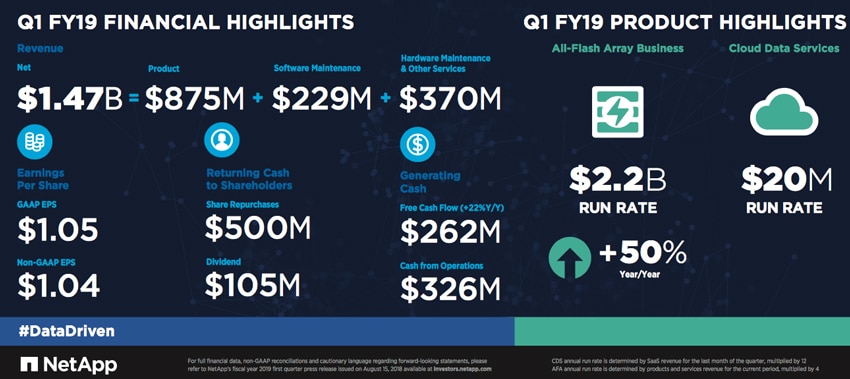

Looking at the numbers, NetApp is reporting revenue of $1.47 billion up form 12% from this time last year but down from the previous quarter’s $1.64 billion. GAAP net income was $283 million (or $1.05/share) up considerably from the same time last year ($131 million) and up some from last quarter’s $271 million. For non-GAAP net income the company is reporting $281 million (or $1.04/share) down from last quarter’s $288 million. Cash, Cash Equivalents and Investments equaled $4.8 billion with cash from operations being $326 million.

Like most other publicly traded companies, NetApp repurchased a large amount of its shares, $605 million worth. This $605 million numbers also includes a cash dividend of $0.40 per share to be paid out on October 24, 2018 for those that hold shares as of the close on October 5, 2018.

Throughout the quarter, the company has released new products, solutions, and updates. NetApp has expanded its partnership with the major cloud through Azure NetApp Files and NetApp Cloud Volumes Services for Google Cloud Platform. The company released it’s first end-to-end NVMe array that supports 30TB SSDs with the AFF A800. And it continues to update its ONTAP 9 software.

Net quarter the company is expecting a revenue between $1.45-$1.55 billion and earning per share between $0.79-$0.85 GAAP and $0.94-$1 non-GAAP.

Sign up for the StorageReview newsletter