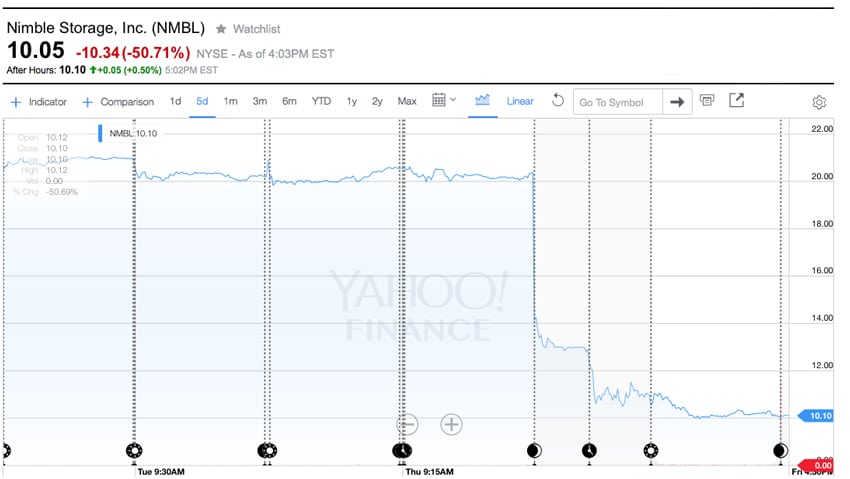

Nimble Storage reported its third quarter earnings Thursday and the news wasn’t exactly terrific. While their revenue was up 37% over this same quarter last year it was about $7 million under analysts expectations. Nimble also reported a greater loss than expected at $11 million. And the final bit of bad news was that fourth quarter estimates are also going to be lower than expectations.

Image courtesy Yahoo Finance

Nimble has recently shifted its focus from mid-sized enterprise business to large enterprise all while attempting to break even on operating income in the fourth quarter. While Nimble has been able to acquire more customers in the large enterprise space (“at a strong pace” according to CEO Suresh Vasudevan), they state that these investments are taking longer to become fully productive. And the focus on large enterprise is causing the company to lose ground in the small to medium enterprise sector. Nimble’s new plan is to sustain investment in large enterprise while shifting a great focus back to its SME business.

It wasn’t all bad news for Nimble. They were able to win a handful of awards and distinctions including being named a leader in the Gartner Magic Quadrant for General-Purpose Disk Arrays, ranked in the top 10 fastest growing companies in North America Deloitte's Technology Fast 500 Awards, and received the rising star award from Global Technology Distribution Council. Nimble was also able to add 617 new customers in the third quarter.

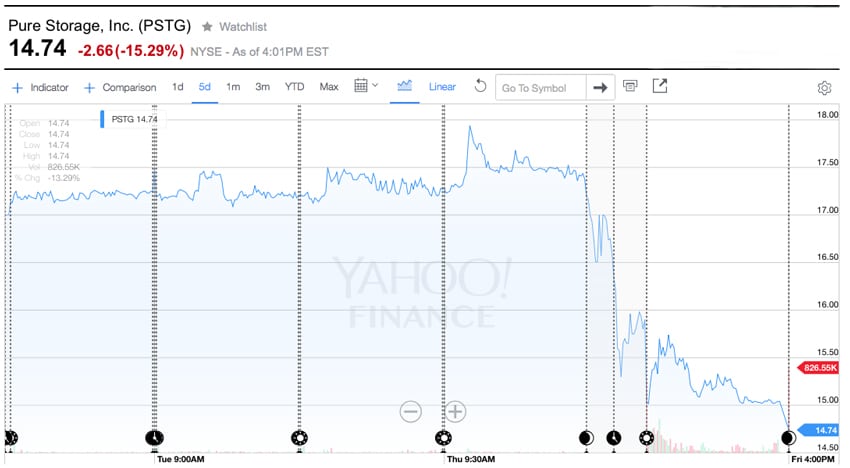

Image courtesy Yahoo Finance

Nimble wasn’t the only smaller tech company that had a bad week on the market. Pure Storage went public last month with a bit of a bumpy start, and as one can see above didn’t fare too well this week in the market. Violin Memory is another example of a company going public only to see its stock drop and drop. This poor performance may hurt other startups that are thinking of going public. Not many investors are going to flock to their stocks with performances such as these. And with major mergers such as Dell and EMC, the large companies will be able to put a bigger squeeze on the competition, making more difficult for the small guys to pry away new customers.

Sign up for the StorageReview newsletter