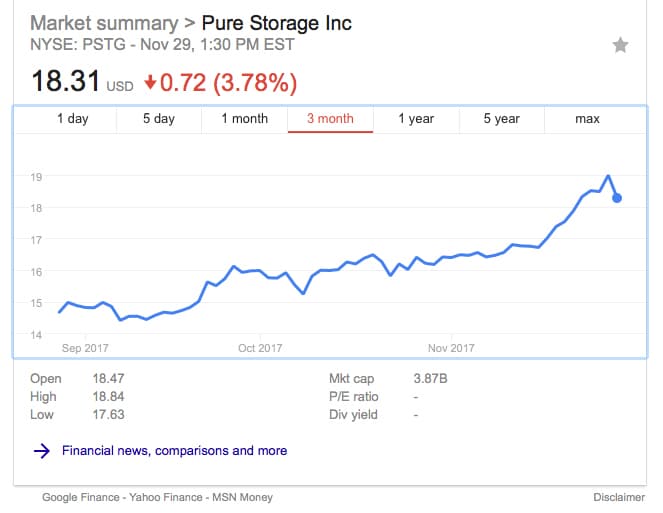

Pure Storage announced its earnings for the third quarter of its fiscal year of 2018, which ended on October 31, 2017. Once again the company reported a very glowing earnings report with record revenue. However, their stock dipped slightly on next quarter’s expectations being lower that what analyst thought they should be.

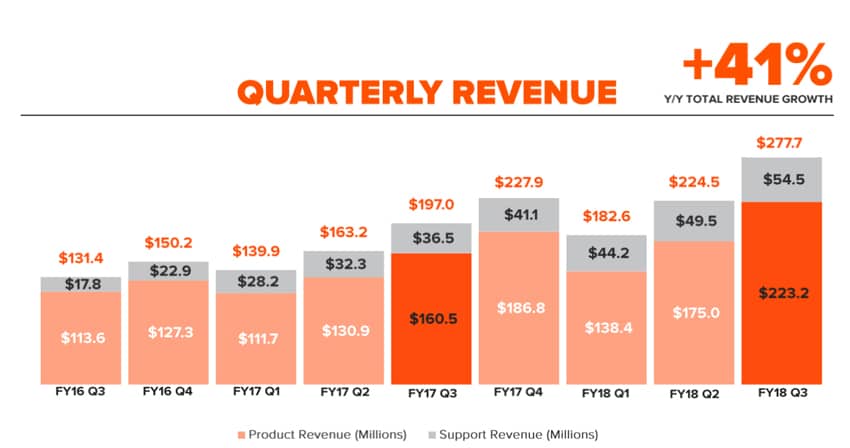

Looking at the numbers for the quarter, Pure is reporting revenue of $278 million up 41% from this time last year and up from $224.5 million last quarter. Gross margin was of 65.5% GAAP and 66.4% non-GAAP down on both from the previous quarter but up from this time last year. The company is also reporting a GAAP operating loss of -$41.8 million and a GAAP net loss of -$41.6 million (non-GAAP -$2.1 million and -$1.9 million respectively).

Pure reported that it has gained around 300 new customers in this quarter bringing its total over 4,000. They company is also reporting cash flow from operations at $28.2 million and free cash flow at $14 million. Cash and investments at the end of this quarter or reported at $551 million.

Looking forward, the company is expecting a revenue of $327-$335 million for next quarter as well as $1.012-$1.020 billion for the fiscal year end. Next quarter they expect a non-GAAP gross margin between 63.5%-66.5% and a non-GAAP operating margin between 3%-7%. For the year, Pure expects a non-GAAP gross margin of 65.6% to 66.6% and a non-GAAP operating margin of -4.9% to -3.5%.

Sign up for the StorageReview newsletter