Violin Memory’s future is looking fairly bleak at the moment, and that may be framing it in a positive light. Violin Memory has been struggling for some time now and all indications are pointing to the company not surviving too much longer. VMEM has been delisted from the NYSE and now trades over the counter. This in itself isn't a problem, but the more glaring issue is the company is now valued at roughly $6 million now which is a good indicator that the company's assets and net cash aren't in good shape.

Violin Memory’s future is looking fairly bleak at the moment, and that may be framing it in a positive light. Violin Memory has been struggling for some time now and all indications are pointing to the company not surviving too much longer. VMEM has been delisted from the NYSE and now trades over the counter. This in itself isn't a problem, but the more glaring issue is the company is now valued at roughly $6 million now which is a good indicator that the company's assets and net cash aren't in good shape.

Violin Memory’s future is looking fairly bleak at the moment, and that may be framing it in a positive light. Violin Memory has been struggling for some time now and all indications are pointing to the company not surviving too much longer. VMEM has been delisted from the NYSE and now trades over the counter. This in itself isn't a problem, but the more glaring issue is the company is now valued at roughly $6 million now which is a good indicator that the company's assets and net cash aren't in good shape.

In order to stay afloat to this point, Violin has already done a reverse stock split (basically they took four shares of stock and combined them into one in order to get the price above one dollar per share, an NYSE requirement). The first reverse split saw the stock jump up to over four dollars per share, but four months later it is down to around $0.25/share. They've been warned by the NYSE a few times, the recent delisting coming after failing to maintain a market cap over $15 million for 30 days.

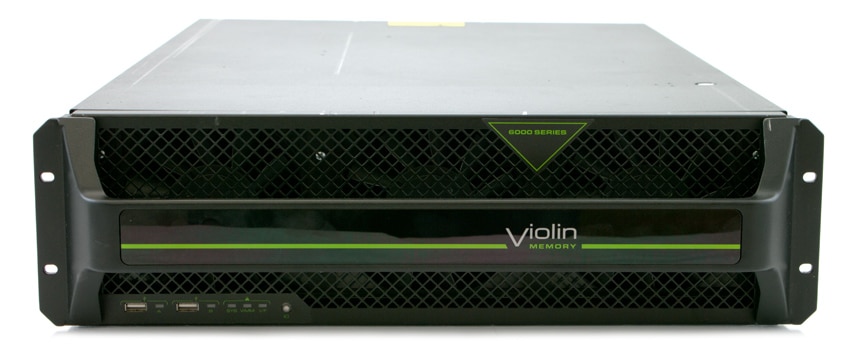

Violin’s main issue is not its product line exactly; Violin’s arrays have been able to meet performance expectations. We saw good results with the WFA in our lab a year ago. However, they are both expensive and use proprietary gear. Instead of using a standard SSD, Violin uses its own VIMM. While there may be some advantages to using a VIMM, being non-standard means users have no choice but to purchase another one from Violin if anything goes wrong. Violin has also struggled with a lack of data services in their non-Windows arrays, which has limited enterprise viability beyond fringe workloads.

Ultimately the flash array market has passed Violin by. Management has been inconsistent and their direction has changed frequently. The bottom line is that many other companies can do what Violin does and they can do it for less. Violin's current problem then is a cash issue. On July 31st they had $36.4 million in cash and cash equivalents according to regulatory filings. The quarter before they had $49.2 million. Sales have deteriorated as well quarter over quarter, setting the company up for problems, especially as the revenue is weighted toward services and support.

The most recent quarter ends today, though it will be a little while still before the company reports financials. It's hard to imagine a scenario where revenues pick up or new funding comes in to continue to support the operation. More likely, some time this year, the debt holders will pressure the company for payments it cannot make, forcing the company into bankruptcy. Surely Violin is working furiously to ensure that does not happen, seeking any alternative including the sale to another storage company. At this point however, it's hard to imagine a positive outcome, considering the company could have been bought out for what amounts to a rounding error for major players like Dell EMC, HPE or Cisco. For perspective, even Nimble, which has struggled mightily, has a market cap of nearly $650 million; roughly one hundred times more than Violin.