Western Digital Corp (WDC) announced it financial results for its fourth quarter (ending on June 30, 2017) and for the year. Though the overall numbers look pretty good, the company was able to beat estimates by twelve cents, its stock price still took a bit of a fall today. The drop in stock price had more to do with the company’s projected outlook than its previous performance.

Looking at the numbers, WD reported revenue of $4.8 billion for the quarter, up from $4.64 billion last quarter and up from $3.5 billion the same time a year ago. The company reported an operating income of $652 million and a net income of $280 million (or $0.93/share), up considerably from this time last year where WD saw an operating loss of $195 million and a net loss of $365 million. The company also generated $1 billion in cash from operations this quarter.

For the fiscal year, WD saw revenue of $19.1 billion up from last year’s $13 billion. The company reported an operating income of $2 billion and a net income of $397 million (or $1.34/share), again a considerable improvement over last years operating income of $466 million and net income of $242 million. The company generated $3.4 billion in cash and returned $574 million to shareholders in dividends.

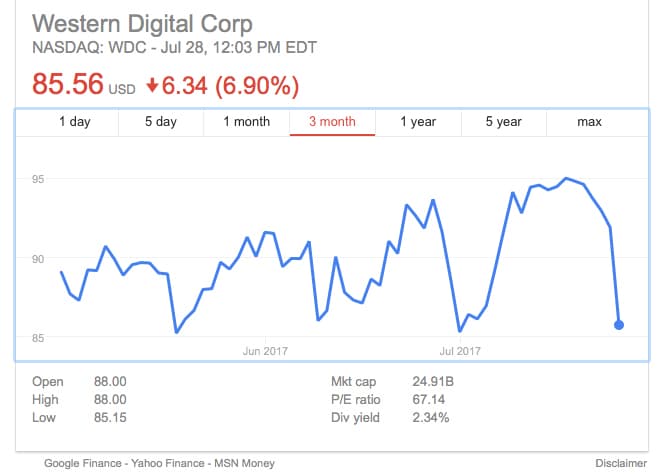

Western Digital projected revenue of the current quarter at $5.1 billion, under the estimates of $5.21 billion. This lower than expected projection drove the stock prick down somewhat through the day.

Sign up for the StorageReview newsletter