After what seems like an eternity and objections from more governments than should be reasonable, Western Digital can finally breathe easy after announcing the close of the acquisition of Viviti Technologies Ltd., formerly Hitachi Global Storage Technologies. The terms called for $3.9 billion in cash payment and 25 million shares of WDC common stock valued at approximately $0.9 billion. Hitachi Ltd. now own roughly 10% of Western Digital’s outstanding shares.

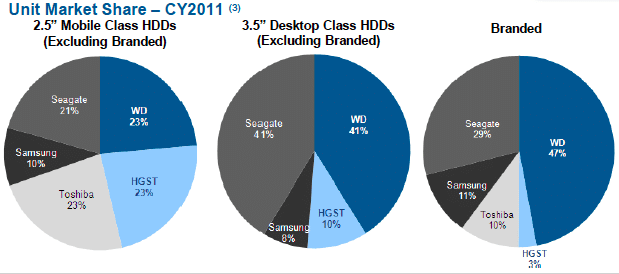

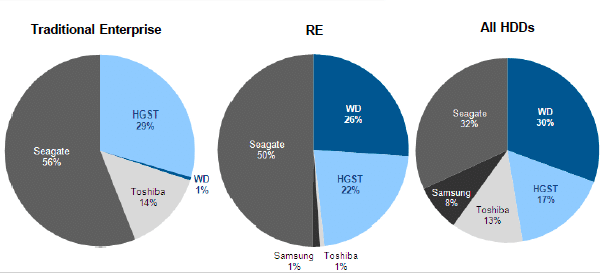

The new Western Digital will continue to operate Hitachi GST as a wholly owned subsidiary, so for the time being, the product mix and branding from Hitachi will not change. In aggregate the revenues from the two companies in 2001 were $15 billion. The hard drive market obviously consolidates as a result of this deal and the Seagate acquisition of Samsung. Here’s a breakdown of the hard drive market in 2011.

What will be interesting to see is how Toshiba responds in the 3.5" space. As a result of this transaction, WD and Hitachi provided certain IP assets and manufacturing capability to Toshiba, essentially putting them in the 3.5" hard drive business.

Western Digital has set up a web page with additional information on the deal.

Amazon

Amazon